Financial year 2020/2021

- Activity logically hampered by the health crisis, but strong 4th quarter rebound

- EBITDA remains positive thanks to disciplined financial management and compensations received

- Maintaining a high level of investment, mainly in the mountains

- Strong cash position at year end

The Board of Directors of Compagnie des Alpes approved the consolidated and audited financial statements for the Group for the financial year ended September 30, 2021.

The sharp rebound that occurred last summer is a perfect illustration of the appeal of our leisure offering, but also of the agility demonstrated by the teams at Compagnie des Alpes as they adapted to the constraints imposed by the health situation. On the operational level, we successfully offset more than 40% of the impact on our sales by reducing our operating and overhead costs, largely exceeding the objective that we had set for ourselves. Lastly, on the financial level, we were able to adjust our investment plans, while maintaining them at a high level, particularly in the mountains, arrange for new financing, secure our existing credit lines, and raise 231 million euros via a capital increase whose success attests to the support we enjoy from all our shareholders for our strategic roadmap.

In a direct line from last summer’s resurgence of sales, the new financial year got off to an auspicious start, with record number of visitors in our leisure parks during the Halloween period. In addition, advance bookings for our mountain resorts have returned to a satisfactory level compared with 2019. At the time of this annual results publication, the circulation of new Covid variants is once again creating uncertainty. The crisis has repeatedly demonstrated – most recently when the vaccine passport was instituted at the end of July – that it is possible to combine leisure activities with the protection of our clients and employees.

This vision is supported by an investment plan intended to continue to dynamize our sites’ activity and their appeal as well as to develop value-creating growth drivers to accelerate the development of our leisure sites, to achieve our ambitious environmental targets by 2030, including Zero Net Carbon and be a committed player in the diversification of mountain recreation.”

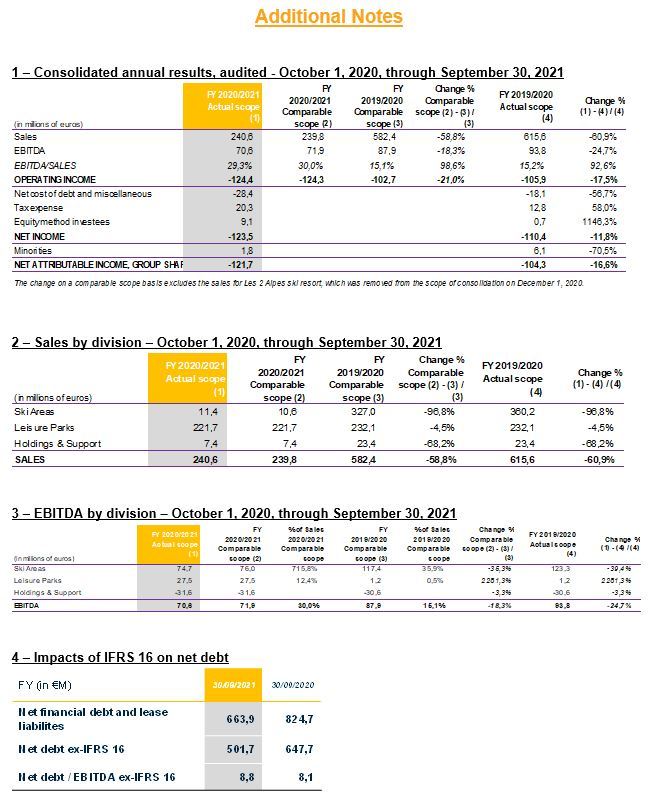

The Group’s consolidated Sales for financial year 2020/2021 totaled €240.6 million, versus €615.6 million for financial year 2019/2020 which, as a reminder, was not impacted by the health crisis until mid-March of 2020.

Ski Area sales came to €11.4 million, compared with €360.2 million in 2019/2020. In fact, ski areas remained closed due to a government order from late October (for those that were open) through the month of June. Activity was dynamic over the course of the 4th quarter, but it represents only a small fraction of annual business. Due to the absence of activity during the winter season, the number of skier days reached just 0.3 million, versus more than 11 million for the previous financial year, which itself was penalized by the forced closure of ski resorts from mid-March through the end of the winter season.

Leisure Park sales were also affected by the government-ordered shutdown of sites from the end of October until they were gradually reopened in the second half of the 3rd quarter. Boosted by a significant increase in spend per visitor and solid attendance levels, sales for the 4th quarter were particularly dynamic. As a result, sales for the year were up by 5.6% (restated for the impact of the closure of the two Belgian sites that were flooded) compared to 2018/2019, itself a record year. For financial year 2020/2021, sales totaled €221.7 million, a level that is close to the previous year (€232.1 million, i.e., -4.5%).

Sales for Holdings & Support came to €7.4 million, compared with €23.4 million for the previous financial year. This decrease is mainly the result of the impact of the health crisis on Travelfactory’s sales.

Thanks to good sales performance over the course of the 4th quarter, combined with good operating expense discipline and various financial assistance and compensation received, Group EBITDA totaled €70.6 million, versus €93.8 million for the previous financial year, a decline of 24.7%. On a comparable scope basis, the decrease is even more limited (-18.3%).

Throughout the year, the Group maintained its efforts aimed at limiting the impact of the health crisis, reducing its structural and operating costs. As a result, it was able to offset 41% of lost sales compared to financial year 2018/2019 through reductions in operating expenses (including €22.0 million in indemnities related to partial unemployment obligations and exonerations from social charges in France). The percentages were 39% for Ski Areas and 39% for Leisure Parks.

During this financial year, the Group was also the beneficiary of financial assistance and indemnities totaling €189.4 million:

- €168.3 million net of partial compensation to the operators of ski lifts for fixed costs in France,

- €21.1 million in other forms of financial aid and subsidies offered in France and abroad.

Ski Area EBITDA remained positive for the financial year thanks to the partial offset of fixed costs for ski lift operators. It came of €74.7 million, versus €123.3 million for financial year 2019/2020. It also benefited from partial unemployment and equivalent measures for €13.5 million.

Leisure Park EBITDA was €27.5 million, versus €1.2 million for the previous financial year. It was driven by dynamic sales over the 4th quarter. Leisure Parks also received financial assistance and indemnities, both in France and abroad, for €20.1 million, and benefited from partial unemployment and equivalent measures totaling €7.5 million.

For Holdings & Support, EBITDA was virtually unchanged despite the crisis and totaled -€31.6 million. The decline in EBITDA for Travelfactory and the real estate businesses, related to the total blank in ski resort bookings, was partly offset by financial assistance credited to holdings.

Depreciation and amortization expense came to €140.0 million, versus €148.4 million for the previous year, notably due to the removal of Les 2 Alpes from consolidation. On a comparable scope basis, the decrease in amortization expense was €4.1 million. The total for financial year 2019/2020 included one-off items totaling €6.6 million. The total for this year includes a one-off impairment of €3.4 million for Chaplin’s By Grévin.

Primarily due to goodwill depreciation for Leisure Parks recorded in the 1st half for a total of €55.2 million, the Group’s Operating Income was -€124.4 million, versus -€105.9 million for financial year 2019/2020, which also included goodwill depreciation for Leisure Parks and Travelfactory totaling €48.8 million.

The Group’s net cost of debt went from €12.6 million in 2019/2020 to €20.3 million for this financial year due to an increase in the average financial debt, an exceptional expense of €4.3 million related to the extension of the first government-backed PGE loan, and a €1.1 million increase in interest expense on rent payables.

The Group recorded a current and deferred tax benefit of €20.3 million, an amount that reflects the activation of tax loss carryforwards for €17.5 million as well as a tax benefit linked to the raising of the carryback ceiling for €3.4 million.

Net attributable income, Group share for financial year 2020/2021, is negative, -€121.7 million, compared with -€104.3 million for the previous financial year.

As the Group had promised, net industrial investments[1> were contained: they came to €143.4 million versus €175.1 million for the previous financial year. After booking the proceeds for the sale of Les 2 Alpes assets (€51.1 million), the net total was €92.3 million, a high level in this context of crisis.

For Ski Areas, net investments were €75.6 million, up by 16.2% on a comparable scope basis, compared with the previous financial year.

As expected, the effort to reduce investments compared with 2019/2020 was greater for Leisure Parks. Accordingly, the net investment amount was €57.9 million, versus €86.1 million for the previous financial year (-32.7%).

Net investments for Holdings & Support related to the Group’s digital strategy with respect to its two historic divisions (CRM, Datalake, websites) and Travelfactory increased by 10.1%, to €9.8 million.

Free Cash Flow[1> for financial year 2020/2021 improved, to -€14.6 million, compared with -€74.4 million during the preceding financial year.

After taking into account financial investments for €36.1 million (including, in particular, the acquisition in October 2020 of a 10% equity stake in Futuroscope, the change in loans to non-consolidated companies, and the acquisition of Evolution 2), the payment of interest expense in the amount of €11.1 million, and net proceeds totaling €226.8 million in connection with the capital increase carried out in June 2021, the Group’s net debt ex-IRFS 16 decreased by €146.0 million over the course of the financial year, to reach €501.7 million as of September 30, 2021, versus €647.7 million as of September 30, 2020.

Down by €14.8 million, debt on lease commitments was €162.2 million as of September 30, 2021. Group net debt post-IFRS 16 thus totals €663.9 million as of September 30, 2021, versus €824.7 million as of September 30, 2020, a decrease of €160.8 million.

Liquidity

- Liquidity

Over the financial year under review, the Group secured its liquidity position to deal with the health crisis. In addition to the rollout of cost-saving plans and adjustments to its investment plans, the Group benefited from financial assistance and offsets for its fixed costs (€189 million), implemented a PGE Saison government-backed loan (€269 million) in December 2020, received the proceeds on the sale of Les 2 Alpes assets (€51 million), and in April 2021 extended its first PGE loan (€200 million), rescheduling its repayment in 8 installments occurring between 2023 and 2026.

In May 2021, the Group was able to obtain the suspension of its 3.5x financial covenant from its banking and bond partners for the next two dates on which it was scheduled to be tested, i.e., September 30, 2021, and March 31, 2022. In June 2021, the Group completed a capital increase with preferential subscription rights maintained (€231 million) prior to the strong business recovery that occurred in the 4th quarter after the reopening of its sites.

As a result, the Group closed out the financial year with a liquidity position[2> of €696 million as of September 30, 2021. This position is comprised of its available cash on hand, its undrawn revolving credit line, and its undrawn overdraft lines.

In view of this strong liquidity position, the Group intends to partially repay up to €139 million on its PGE Saison government-backed loan, which was for a total amount of €269 million, when it falls due in December 2021. Conversely, the evolution of the health situation over the last few days has led the Group to request, as a precaution, an extension on the remaining outstanding balance of this loan, i.e., €130million, over a two-year horizon to maintain the latitude necessary to pursue the implementation of its strategy aimed at increasing growth and attractivity.

Dividend

Because of the health crisis and its impacts on the activity of Compagnie des Alpes over the course of this financial year 2020/2021, the Board of Directors will recommend at the upcoming annual shareholders’ meeting, scheduled for March 10, 2022, that no dividend be paid out in respect of financial year 2020/2021.

The Group nevertheless confirms that its objective is to return to a distribution rate that is at least equivalent to the pre-crisis level as of 2022/2023 (in respect of financial year 2021/2022), an objective that the Group deems perfectly compatible with its growth and investment strategy.

Outlook

These outlook statements are provided subject to the evolution of the health crisis.

Ski Areas

To date, the ski season is off to a good start, and ski resorts were able to open on the official season start dates. Both snow and cold weather have made their appearance at nearly all major mountain ranges, leading to a satisfactory advance booking level. The evolution of the pandemic in the coming weeks will be decisive for the rest of the season, beginning with the Christmas/Year end school holiday period.

Leisure Parks

Financial year 2021/2022 began for the Leisure Parks division with the Halloween season. Apart from Aquilibi (closed following flooding in Belgium last July), all sites were open and all experienced dynamic sales, even a record attendance.

Group

- Sales and EBITDA

- Annual Capex Budget

Accordingly, to consider the completion of these two new projects, total investment expenditure is expected to reach around €210 million per year on average for the period from 2021/2022 to 2024/2025 (versus €200 million announced previously, except Grand Astérix and Grand Massif).

This annual average includes a budget for investment that falls short of this average for 2021/2022, which is expected to be around €160 million.

- Financing Debt Leverage/Gearing Ratio

This press release contains forward-looking statements concerning the prospects and growth strategies of Compagnie des Alpes and its subsidiaries (the “Group”). These statements include indicators pertaining to the Group's intentions, strategies, growth outlook and operating result trends, financial situation, and cash position. Although these indicators are based on data, assumptions, and estimates that the Group considers to be reasonable, they are subject to many risk factors and uncertainties such that the actual results may differ from those anticipated or induced by these indicators due to a multitude of factors, in particular those described in the documents registered with the Autorité des marchés financiers (AMF), available on the Compagnie des Alpes website (www.compagniedesalpes.com). The forward-looking statements contained in this press release reflects the information given by the Group as of the date of this document. Legal obligations to the contrary notwithstanding, the Group expressly declines any obligation to revise or update these provisional statements in light of new information or future developments.

Upcoming Events:

- 1Q 2021/2022 Sales: Thursday, January 20, 2022, after stock market closes

- Annual Shareholders’ Meeting: Thursday, March 10, 2022, afternoon

- 2Q 2021/2022 Sales: Thursday, April 21, 2022, after stock market closes

- 1H 2021/2022 Results: Tuesday, May 24, 2022, after stock market closes

[1> See glossary

[2> See glossary

[3> See glossary

[4> Net debt ex-IFRS 16 / EBITDA ex IFRS 16

[2> See glossary

[3> See glossary

[4> Net debt ex-IFRS 16 / EBITDA ex IFRS 16